Press Release: PayPal Adds New Features to Its Complete Payments Solution for Online Small Businesses

PayPal Adds New Functions to Its Comprehensive Payments Answer for On the internet Small Corporations

PayPal’s on the net payment remedy enables SMBs to acknowledge PayPal payments, credit rating and debit cards, electronic wallets and additional. Starting currently, SMBs will also be equipped to acknowledge payments with Apple Pay®, make it possible for their buyers to save payment approaches with the PayPal vault and maintain their cards up to day with true-time account updater, as effectively as get access to capabilities to help them run their enterprise together with interchange in addition additionally (IC++) pricing with gross settlement.

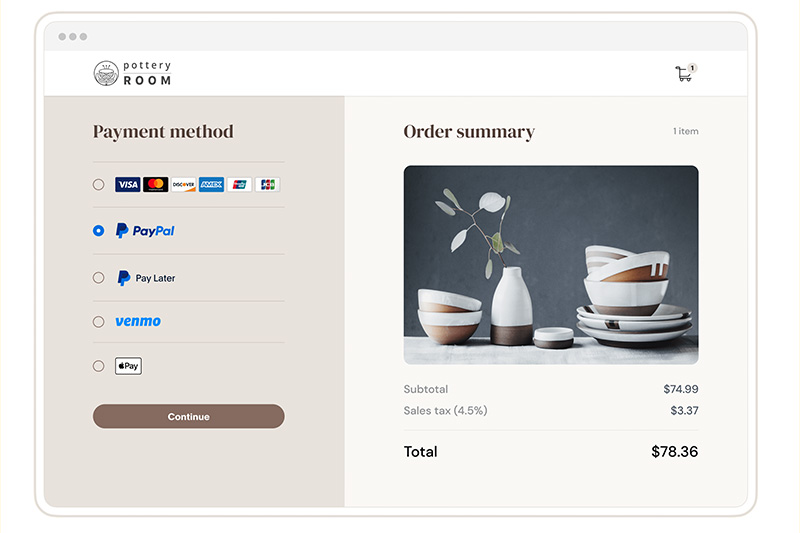

SAN JOSE, Calif., April 4, 2023 /PRNewswire/ — PayPal Holdings, Inc. (NASDAQ: PYPL) right now introduced it has included new capabilities to its finish payments answer for smaller companies. The solution permits compact enterprises to acknowledge a range of payments which includes PayPal, Venmo and PayPal Pay out Afterwards solutions. Giving consumers additional option in how they can spend can support generate checkout. Fifty-nine per cent of respondents of a new Ponemon Institute research mentioned their prospects regularly abandon their buying cart when their favored payment method is unavailable.1 PayPal’s entire payments answer also permits small firms to course of action card payments specifically on their website, and customize the checkout working experience to match the look and feel of their brand name, all by way of a one integration.

Commencing nowadays, PayPal will also give little corporations access to 4 new options to aid them push payment acceptance and increase how they operate their business enterprise. This will include Apple Pay as a checkout option2, the potential for customers to save payment techniques with the PayPal vault for more rapidly potential checkout, serious-time account updater to enable prospects preserve their payment approaches up to date, and access to IC++ pricing.

“The retail landscape is consistently evolving and SMBs have to have obtain to a array of applications to help them drive gross sales, slash costs and shield on their own and their customers from fraud,” stated Nitin Prabhu, VP, Service provider Encounters and Payment Solutions, PayPal. “With our total payments solution, little companies can get entry to all of these instruments with 1 integration.”

Enabling extra payment decision to support travel checkout

Tiny enterprises that are leveraging PayPal’s total payments resolution will now be equipped to accept Apple Pay together with a range of other well-liked payment choices. Apple Pay gives their buyers an easy, protected and personal way to pay out on line and in-applications when utilizing Apple® gadgets3.

Simplifying the checkout practical experience to aid drive conversion

In addition, PayPal’s total payments solution now allows customers to securely help you save their payment info on a business’s ecommerce site for potential buys. This can cut down friction and travel conversion. By allowing PayPal aid handle some of the business’s PCI compliance for the storage of financial instruments, corporations are far better ready to handle possibility and complexity of their organizations. Tiny businesses can help save a number of payment procedures — including PayPal, Venmo and cards — in the PayPal vault. After saved, these payment techniques will continue to be new by way of PayPal’s real-time account updater provider and network tokens, which can assist cut down declines and push conversions by instantly updating dropped, stolen or expired playing cards-on-file.

Assisting organizations much better manage their cashflow and get additional clear pricing

Modest businesses will continue to get obtain to capabilities like automated transfer, which aids corporations far better handle their cashflow. Businesses will now be capable to opt for among flat-charge pricing or an IC++ pricing model, which can help them get paid the complete amount of money up-entrance and get a clear see into processing costs.

Serving to retain enterprises and their buyers protected

To enable keep small corporations secure in an surroundings wherever fraud is on the increase, PayPal’s full payments answer will keep on to offer you Fraud Protection,4 Chargeback Security5 and Vendor Security6, on suitable transactions. SMBs will also get 1 of the marketplace-major costs on processing service fees for card payments, alternative payment techniques and other digital wallets, at just 2.59{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} + 49 cents. Pricing for PayPal payments is 3.49{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} + 49 cents7.

You can master far more about PayPal’s comprehensive payments remedy here.

About PayPal

PayPal has remained at the forefront of the electronic payment revolution for more than 20 decades. By leveraging technological know-how to make economic services and commerce far more easy, very affordable, and protected, the PayPal platform is empowering 435 million energetic accounts in a lot more than 200 markets to be part of and thrive in the world-wide economic system. For much more data, check out paypal.com.

1 Ponemon Institute, Commissioned by PayPal. The 2022 Accurate Price of On the internet Fraud Worldwide Study.

2 Fork out with Apple Pay on State-of-the-art Checkout is presently for 1-time transactions with recurring payment assist to be extra quickly.

3 Apple and Apple Pay are registered trademarks of Apple Inc.

4 Fraud Protection is readily available on “Advanced Card Payments” (unbranded processing) and branded PayPal payments but not guest transactions.

5 Sure chargebacks are not qualified for the Chargeback Safety resource. See terms for details. Chargebacks that are not similar to fraud or item not been given (INR), this sort of as broken Merchandise, noticeably not as explained (SNAD), refund not processed, and duplicate charge, are not secured by Chargeback Protection. Chargeback Security is accessible for accounts enrolled in Highly developed Credit and Debit Card Payments.

6 Obtainable on suitable buys. Restrictions apply.

7 Expenses are issue to transform.

Speak to: Grace Nasri, [email protected]

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/SL4ZJEXTC5DIXNN4OZFLJTU4UE.jpg)