Payment and Expense Trends for a New Generation

Digitization of the client encounter is influencing each corner of company journey. When it comes to payments and expense administration, that implies offering much more seamless solutions for workforce so that they never have to figure out how to pay back for organization vacation, manually gather and input receipts, or devote several hours filing cost studies.

It’s not just about the consumer working experience these options present organizational efficiencies as well. Businesses that are not completely ready to make the shift to virtual cards and automated expenditure administration are now out of sync — with money technologies advancements, with travel provider payment methods, with inner departments, and eventually with what their employees want.

This posting explores important behavioral variations between enterprise vacationers and how organizations can regulate their company travel, payment, and expenditure procedures and processes in techniques that improve effectiveness, minimize expenses, and improve employee satisfaction.

Resolving Suffering Details in Payments and Reconciliation

Small business vacationers globally are progressively demanding that their companies offer technological know-how they use in daily everyday living. For instance, contactless payments turned substantially much more prevalent all through the Covid-19 pandemic, and contactless transaction values are predicted to double in the upcoming five yrs. Company card people who’ve adopted this technological innovation in their individual lives now expect the identical simplicity and simplicity of use when they journey for perform.

The shifting tech landscape has led company journey and finance administrators to an inflection stage as properly. Coordinating business vacation is complicated, and the payment and expenditure management process by itself is highly-priced and agonizing to deal with.

“Expense management is a reactive system,” reported Ajay Singh, vice president, electronic payment and expense item development at BCD Journey. “Plus, there are all these unique traveler profiles — VIPs, road warriors, rare tourists, even non-workforce — who all have distinct demands, and that leads to a large amount of agony for travel supervisors.”

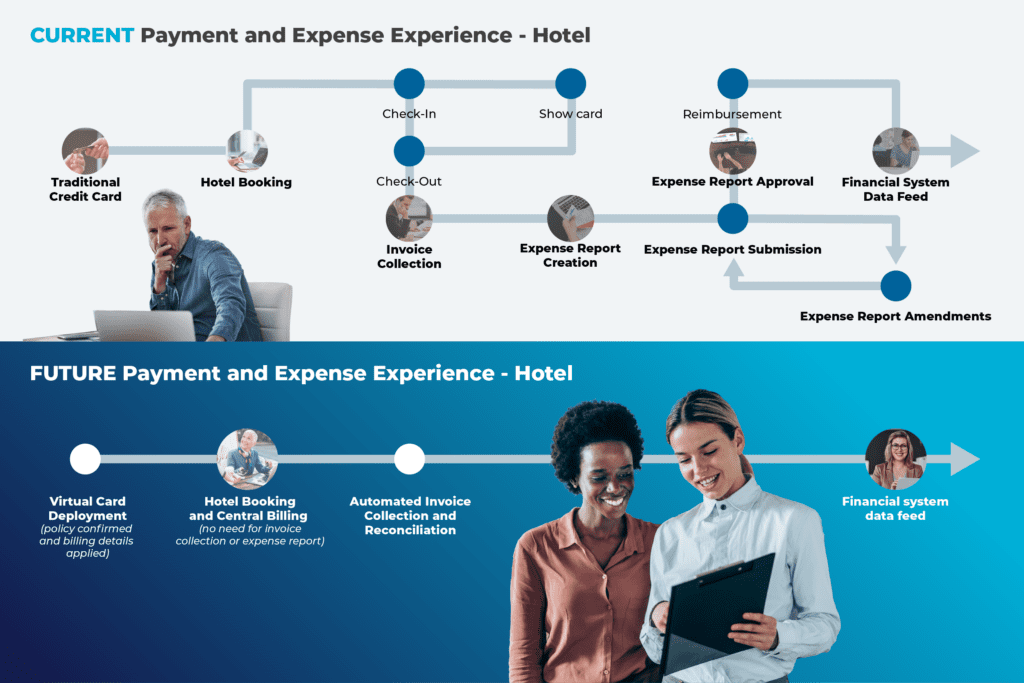

Traditionally, the root of the obstacle for cost management has been the absence of integration amongst distinct devices and procedures. (See the picture down below for a snapshot of what a typical payment and price knowledge for a lodge reserving appears to be like like currently.) Digital playing cards are a person illustration of how electronic alternatives combine payments, coverage, and cost management to make the system additional proactive. By bringing these aspects together, they existing a substantial possibility to renovate corporate vacation, payment, and expenditure, Singh claimed.

One essential advantage of virtual playing cards — which can be deployed during a vacation scheduling or just before a start of the excursion as a unique card or payment token by using a user’s mobile cellphone — is that they’re versatile. They can be possibly a single-time or multiple-use, and they can have a preset restrict. In the foreseeable future, digital playing cards will be ready to be provisioned into mobile payment techniques this kind of as Apple Shell out, Samsung, and Google Fork out for a individual excursion or certain devote.

Yet another critical edge is that supervisors can embed guidelines close to how people digital playing cards can be employed — and update them promptly in reaction to specific situations alternatively of possessing to critique and reissue an complete company journey plan.

Also, rather of issuing a plastic card that lasts a few or five or seven yrs and can be swiped whenever and wherever, a digital card is a great deal much more controlled. Since virtual cards have numerous designed-in coverage, controls, and devote boundaries, they are a lot more safe when compared to a regular card.

Since investing knowledge can all be tracked in real time, there is no require for a traveler to file an price report. As vacationers use their cell phones to pay out contactless for coffee, foods, taxi rides, or hotels, they can get the costs in serious time and add the receipts, if needed, on the go. By the time they are performed with their trip, all the fees, if compliant, are prepared to be pushed into finance and price devices. Corporations can also input the expense heart and billing facts ahead of time so that charges don’t have to be allotted right after the fact.

By automating and integrating payments, coverage, and cost reporting, “you’ve turned the whole course of action upside down,” claimed Singh. “You’ve taken a reactive process with a good deal of handbook methods and manufactured it additional proactive, more authentic time, a lot more dynamic, and much more automated in contrast to what it is currently right now.”

The Promise of a New Payment and Expense System

Transformation is under no circumstances uncomplicated. Initially of all, though there are plenty of early adopters out there, it will consider some time for a the vast majority of today’s company tourists to alter their engineering patterns, even if they are excited by the opportunity added benefits.

There are also sensible things to consider for firms on the technological side. As a single illustration, some automated expense answers do the job by consolidating all vacation costs into a single payment process with a one payment issuer. That will work well in some circumstances, but it is not real looking for packages with a number of suppliers and a number of payment partners.

Meanwhile, hundreds of billions of financial commitment dollars have long gone into monetary technological innovation, or fintech, in the earlier many a long time. That involves retailers that have adopted contactless payment techniques, as properly as major banking institutions and card issuers (i.e. Visa, MasterCard, AMEX) upgrading their existing platforms to help new forms of payment structures on the backend. In addition, extra and far more firms are checking out solutions and providers where tourists do not have to use individual cards for company outings.

With these developments converging, there is an urgency for corporations to continue to keep up, addressing automation requirements so that their individual devices can use the resources and details they are having from suppliers. In the end, businesses have to consider a difficult glance at what satisfies their technological capabilities and their touring workers very best, and then perform collectively with their vacation administration enterprise and engineering companions to develop the proper blend of options to start their payment and expense journey.

“The digitization of company vacation is heading to go as a result of a phased transformation that will shape out above the upcoming couple of many years, requiring instruction and early adopters to arrive on board,” claimed Singh. “But there’s a large benefit proposition that these new options are bringing to the marketplace — merchants, their clientele, assistance vendors like us, and the traveler.”

The downside for the duration of this transformation interval is contending with the status quo, which is characterised by fragmented procedures and devices. There are silos inside businesses by themselves, silos in between travel suppliers and distribution methods, and silos in between monetary establishments, which all go decades back. As just one transaction moves through from stop to close, every method is various and has distinctive facts and facts.

The antidote to this fragmentation is info integration. By seamlessly and proactively connecting journey to payments to automated price reporting and reconciliation, providers will be in a position to assemble a lot more steady, additional precise details, which can make it possible for them to consolidate this info into a solitary watch of their method.

Singh famous that data integration ordinarily has been a agonizing, handbook course of action sitting with distinct teams. By employing synthetic intelligence/machine studying capabilities to deliver a ton of knowledge sets with each other, companies are in a position to match, reconcile, and simplify those procedures.

“The resolution is tying every thing alongside one another at the time of booking and at the time of the vacation,” explained Singh. “So as a substitute of a backward-searching price management approach, you enhance or take away price administration as we know it right now. It’s even now occurring, but all in the qualifications. The payment results in being your price management, and the plan is embedded together. It’s reactive to proactive, handbook to automatic, elaborate to easy.”

For much more info about BCD Travel’s payment and expense option, go to https://www.bcdtravel.com/journey-administration/bcd-pay back/.

This material was designed collaboratively by BCD Vacation and Skift’s branded material studio, SkiftX.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/SL4ZJEXTC5DIXNN4OZFLJTU4UE.jpg)