Additional New York State child and earned income tax payments

The 2022–2023 New York State funds provides for just one-time checks to suitable taxpayers for two individual payments:

- just one dependent on the Empire State youngster credit, and

- a person based mostly on the acquired income credit rating (or noncustodial mum or dad acquired earnings credit score).

If you qualify for a payment for 1 or both of those credits, you do not want to do something we will automatically determine and deliver you one particular check that will incorporate the complete volume you’re entitled to.

Am I eligible?

You are entitled to a payment if, for tax 12 months 2021, you acquired at minimum $100 for either or each of the subsequent credits from New York State:

You must also have submitted your New York State money tax return (Kind IT-201) by April 18, 2022, or had a valid extension of time to file.

When will I get my verify?

We began mailing checks to suitable taxpayers in Oct 2022, and proceed to mail checks as we process returns.

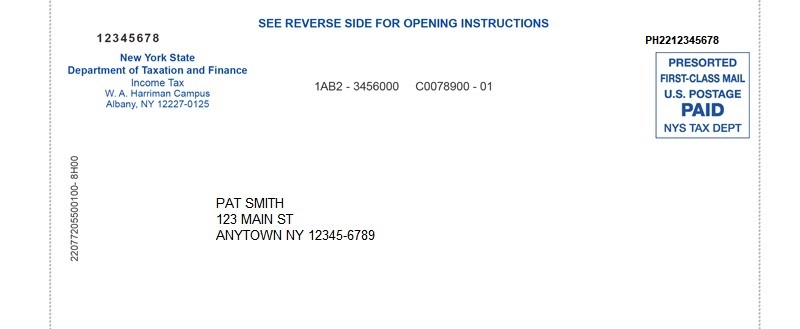

Observe your mailbox for a check that seems to be like this:

We can’t present a certain shipping plan, and our Get hold of Center representatives have no more information.

How a lot is the look at?

Your test amount of money will be centered on your 2021 Empire Point out kid credit, your New York State earned income credit (or noncustodial mother or father attained earnings credit score), or both.

The payment for the Empire State little one credit history is any where from 25{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} to 100{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} of the sum of the credit score you acquired for 2021. The proportion depends on your earnings.

The payment for the earned earnings credit history (or noncustodial guardian attained money credit) is 25{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} of the volume of the credit rating you obtained for 2021.

If you qualify to receive a check out for:

- only just one payment, your check is equivalent to that payment amount or

- both payments, add together your payment amounts to ascertain your look at quantity.

Take note: If you acquired at the very least $100 for both credit, your check out will involve a payment centered on that credit history. For case in point, if your 2021 New York State attained money credit score amount of money was $80, and your Empire State boy or girl credit was $200, your test will only consist of the payment for the Empire State boy or girl credit rating.

Estimate your examine volume

To estimate the quantity you can expect to obtain, you can expect to need information from your 2021 New York State revenue tax return (Variety IT-201). If you really do not have a copy of your return, log in to the software you employed to file to check out a duplicate, or request the information and facts from your tax preparer (if you employed 1).

The genuine amount you acquire may be diverse than the quantity you believed if there ended up any changes to the sum of possibly credit history claimed on your return. If we adjusted your credit score volume, use the corrected volume in the account adjustment letter (DTF-160) or bill we sent you to estimate your further payment.

Take note: To defend your data, our Call Heart representatives are not able to provide amounts from a return you filed.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/SL4ZJEXTC5DIXNN4OZFLJTU4UE.jpg)