Costco: Very Attractive Quality Consumer Staple Dividend Payer

Scott Olson/Getty Images News

Costco Wholesale Corp

Costco (NASDAQ:COST) is considered to be in the consumer staple sector. It is a wholesale discount supplier by membership fee that provides a broad array of products including food, electronics, jewelry, clothing and more and operates over 800 warehouses internationally. Founded in 1976 in Issaquah, WA. as Costco Companies it changed the name to Costco Wholesale Corporation in 1999. The following are a few statistics:

- $214 Billion market capitalization

- A+ S&P credit rating

- 29.4{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} long-term debt/capital

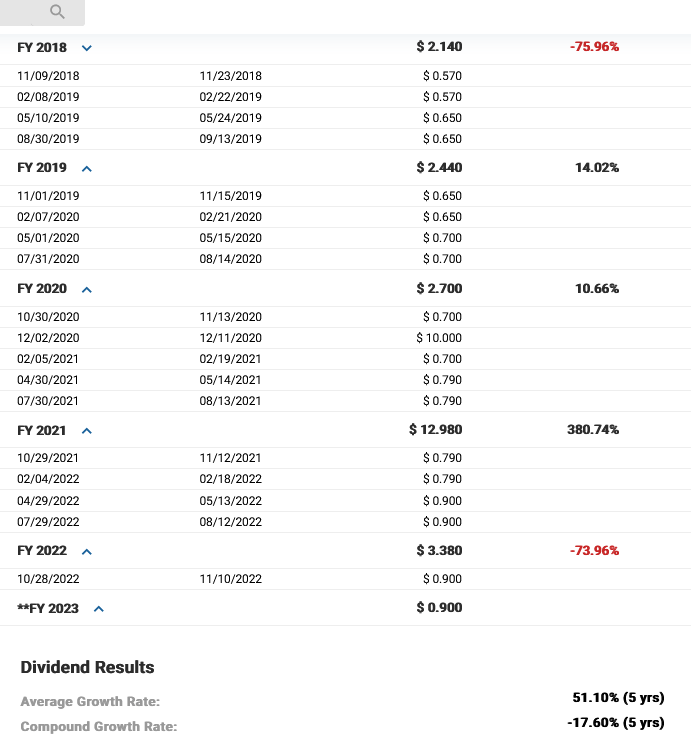

Costco Dividend

- 19 years of rising dividend payments makes it a dividend contender.

The fiscal year runs from August 1st to the end of July each year, which makes the dividends per year somewhat more difficult to track and compare to many other companies that use a calendar year fiscally, meaning January 1st to December 31st.

The dividend for 2022 is $3.60 which at the current price of $461.45 = 0.8{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} yield. It normally pays on a 2-5-8-11 quarterly schedule with the dividend change occurring usually with the May payment. The 5 year dividend growth rate is 51.1{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} if special dividends are included, which occurred in 2017 and 2020. The special dividend of $10.00 was paid separately December 2020. There is nothing announced thus far for 2022.

Dividend payout is ~30{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c}.

Analyst Pricing

The following abbreviations are used in the chart that follows:

Curr Pr/Sh = Current price per share

M* FV = Morningstar fair value

M* Buy = Morningstar lowest and very inexpensive price to buy

VL = Value Line safety score: 1 is the safest/ best and 5 would be very unsafe

VL Mid PT = Value Line 18 month future price target or Mid 2024.

YF PT = Yahoo Finance 1 year future price target

CFRA = TD Ameritrade analyst price target

52 wk Low = current 52-week price low

52 wk High = current 52-week price high

|

Stock |

Curr |

M* |

M* |

VL |

YF |

52 wk |

52 wk |

||

|

Ticker |

Pr/Sh |

FV |

Buy |

VL |

Mid Pt |

PT |

CFRA |

Low |

High |

|

COST |

461.45 |

$476 |

$333 |

1 |

$662 |

$552.6 |

$488 |

$406.51 |

$612.27 |

M* suggests it trades in a fair value range, however lately, it is on the lower end of that range. It still has a way to go to get to that 52-week low of $406.

Morningstar suggests it has a wide moat, which means the company has a large competitive advantage over others in the same field which could last for many years.

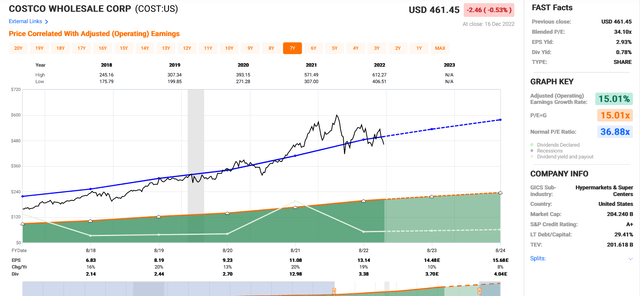

FASTgraphs – FG

FG shows in one picture graph statistics and numbers that help visualize price, dividend attractiveness and much more. The FAST part of FG, just in case you were wondering, means, Fundamental Analyzer Software Tool, which was developed and introduced by Chuck Carnevale, a writer at SA. I have a grandfathered subscription price and enjoy using it.

The following colors/lines on the chart represent the following:

Black line = price

White line = dividend

Orange line = Graham average of usually 15 P/E “price/earnings” for most stocks.

Blue line = Normal P/E

Dashed or dotted lines are estimates only.

Green Area represents earnings.

Statistics by year are noted for high and low prices at the top of each chart in black and for earnings and dividends at the bottom of it. The {3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} shown is for the change from year to year for earnings.

Shown below is a 7-year chart representing the last 5 years along with 2 years of future estimates (dotted lines).

Costco FG

Costco FASTgraph Dec 2022 (FASTgraphs Chuck Carnevale)

Note the white dividend line shows the special 2021 dividend of $10.00 added to the $2.98 normal payments . Earnings in 2020 were up 20{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c}, up nicely from the previous year of 17{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c}. The extra dividend gave the stock price a kick upward to the $600+ level. Wow! Earnings were good in 2022 at 19{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c}, but no special dividend, which now shows a price reaction moving in a slow and saw tooth jerky reaction lower, but still staying above the price lows.

P/E

The here and now blended P/E shown is 34.1x and the normal blue line P/E where the black price line travels is 36.88x. This would suggest the price is below the normal and why M* has it at a fair value of $476, for the here and now today of the past P/E.

2023 estimated growth is to rise up 10{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} to $14.48 earnings, but less, almost 50{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} less than the previous 2 years of 19-20{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c}. The chart suggests an 8{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} rise for 2024, great in a possible recession, but not what this stock has done over the last few years. That information might just bring the price down and perhaps nearer to the orange 15 P/E line which would also equal the estimated 15{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} earnings growth shown in the green box. All would indicate it should sell for a lower future price. Keep that all in mind, but being wholesale, many will probably still keep their memberships. M* has a $333 cheap buy price for it, but I really find that would be difficult to achieve. I am using caution for the price, but more like $420 or so. What really makes it attractive to me as a dividend growth investor is just that… the delightful dividend growth.

Dividend Growth

The dividend listings and the dividend record for the last 5 years from the FG performance section are shown as follows, with the second date shown being the payment date:

5 years of Dividends Costco FG (FASTgraphs by Chuck Carnevale)

With an 0.8{3df20c542cc6b6b63f1c547f8fb389a9f235bb0504150b9df2ff264aa9a6c16c} yield and spectacular dividend growth, this stock has become quite easy to like or want.

Summary/Conclusion

All my family and friends that have joined love the bargains and quality shopping experience they get at Costco. I have been there a few times as a guest and wish we had one near us in Iowa. I understand the love for it and now especially for those special dividends.

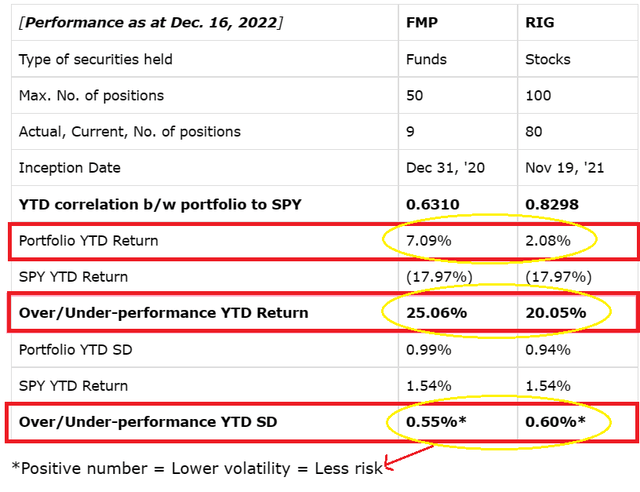

Below are the last results for FMP “Funds Macro Portfolio” found at The Macro Trading Factory and for RIG.

FMP and RIG Dec performance Success (Macro Trading Factory Result TMT)

Please see the marketing bullet point for more information and the sale ongoing to join the service that runs until the new year.

Happy Investing to all!

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/SL4ZJEXTC5DIXNN4OZFLJTU4UE.jpg)